How did TCS begin?

Tata Consultancy Services Limited was started in 1968 by JRD TATA. That is, it has been more than 50 years since TCS started. Earlier it was known as "Tata Computer Systems". Initially, TCS used to make Punch Cards for its own group company TISCO, now known as Tata Steel.

Tata Consultancy Services Limited i.e. TCS is an Indian Multinational IT Services and Consulting company with its Headquarter in Mumbai. TCS is a TATA Group Subsidiary and is working on 149 Locations in 46 countries.

TCS is the second largest Indian company by market capitalization. The market cap of TCS today is more than 9 lakh crore rupees. Tata Consultancy Services is now counted among the most Valuable IT Services Brands worldwide.

Now let's talk about Comapny's SWOT analysis, first of all

About Strengths of TCS Company-

Customer from Different Markets - TCS has a client base of different industries like Banking, Financial services, Retail, Telecom & Media and Entertainment etc. Which is a Positive Signal.

TCS has strategically expanded geographically Diversified Markets across the world including North America, UK, Middle East Europe, Africa and Asia-Pacific.

The company's Return on Capital Employed i.e. ROCE has been continuously improving since last 2 year. Return on Capital Employed is a Financial Ratio that helps in Generate, Profit Percentage from Total Capital on a business. That is, RoCE tells how well the company is using its capital to generate Return in Business.

The company's Net Profit is increasing on a Quarter on quarter basis. The company is generating good cash from Core Business and Cash Flow is continuously improving since last 2 year. Foreign Institutional investors are increasing their shareholding.

Since last 2 year, the company has been effectively using the funds of the shareholders, i.e. Return on equity is improving since the last 2 year. Return on Equity is an important financial ratio that helps in measuring the profit of the company. RoE helps in the measurement of the company's efficiency by using the equity of the shareholder. In other words, it measures how well the company is earning on the shareholder money. It is one of the most useful Ratios from the perspective of investors.

There is no Debt on the company.

The company's Annual Net Profit has also been improving continuously for 2 years.'

Now let's talk about the company's Weaknesses-

Legal battle: In 2014, TCS was accused of misuse of confidential information of software company, Epic Systems. In 2016, TCS was found guilty and ordered to pay damages of 940 Million dollars. TCS opposed the decision and challenged it. The image of the company is affected by such incidents.

The company's book value per share is decreasing by the last 2 year.

The company's Net Cash Flow is decreasing, which means that the company is having trouble maintaining Cash Flow.

TCS subsidiary Diligenta has consistently performed below average.

Now let's talk about Opportunities-

The company's sales and profit are increasing with strong price momentum.

Digital Transformation Technologies- The world is becoming digital and hence Business Dynamics is also turning into Digital Economy. TCS's focus is on digitally transforming itself and providing Digital Solutions. TCS should be ready to spend more on digital transformation technologies.

With the advent of digital changing technology and fast internet connectivity, the whole world is moving towards cloud-based solutions and the expenditure on cloud services is expected to increase at a compound annual growth rate ie CAGR of over 19% in the next 5 years. TCS has a solid infrastructure to provide cloud-based solutions and hence it is a good opportunity for TCS.

Now let's talk of Threats-

Immigration restrictions - With strict immigration restrictions, increase in H-1B visa Fee and changing political circumstances in the US, Indian IT companies may find it difficult to do business as it will cost them and profit affect and hence it will be IT industry There is danger for

TCS faces competition from companies such as Wipro, Infosys, Accenture, Capgemini and Deloitte. This causes pricing wars in the industry and becomes Share Limited in the market.

Now let's talk about TCS Company's Financial Highlights-

The company's revenue was 1,56,949 crore rupees in the financial year 2019-20 which was 1,17,966 crore rupees in the financial year 2016-17. That is, the Revenue of the company has increased by about 25% in the last 3 year.

The company's Profit Before Tax was 42,248 crore Rupees this Financial Year, which was 34,513 crore Rupees 3 years ago. That is, the company's profit before tax has increased by about 19% in the last 3 years.

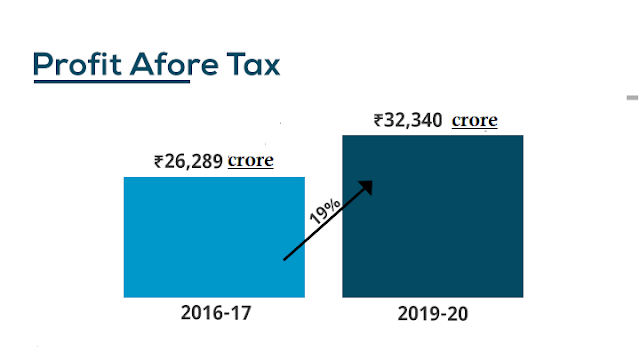

If we talk about Profit after Tax of the company, then it was 32,340 Crore Rupees in Financial Year 2019-20 which was 26,289 Crore Rupees in Financial Year 2016-17. That is, the company's profit after tax has also increased by about 19% in the last 3 years.

Talking about Basic Earnings Per Share in Financial Year 2019-20, it was Rs 86.19 which was Rs 133.41 3 years ago. That is, the basic Earnings Per Share of the company has decreased by about 36% in the last 3 years.

According to TCS Company's Annual Report, the number of shareholders of the company has increased to 32,340 as on 31 March 2020 from 31,472 1 years ago. That is, the number of shareholders in the company increased by about 3% in the last 1 year.

How is the company's management?

Talking about the Board of Directors of the company, Rajesh Gopinathan is the Chief Executive Officer and Managing Director of the company, N G Subramaniam is the Chief Operating Officer and Executive Director of the company, N Chandrasekaran is the Chairman of the company, Aarthi is the Director of Subramanian Company. Apart from this, O P Bhatt, Don Callahan, Dr Pradeep Kumar Khosla and Keki M are independent directors of Mistry Company.

So this was the complete analysis of TCS Company which also includes SWOT Analysis, after this analysis you will be able to understand this company better and you will be able to take your decision about the investment in the company easily. Next, which company you want complete analysis of, tell us by commenting, thank you!

Did you enjoy what you read? Subscribe to our newsletter and get content delivered to you at your fingertips !!

Reviewed by Vansh Jha

on

December 21, 2020

Rating:

Reviewed by Vansh Jha

on

December 21, 2020

Rating:

No comments: